Cleveland, Ohio estate planning attorney, Daniel A. Baron, offers the following information on the Definition and Role of an Executor of your Estate.

Being named and then carrying out the duties of an executor can be one of life’s most frightening tasks however; keep in mind that this is also an honor. Being named an Executor of someone’s estate shows that the person naming you has entrusted you with the great responsibility of making sure their last wishes are granted with respects to the settlement of their property and assets. Fundamentally, an executor of any will is responsible for making sure that any and all debts and creditors of the deceased are paid off, and that any remaining money and/or property of the estate is distributed according to the decedent’s wishes.

Bear in mind that the law does not require an executor to be a lawyer or for that matter a financial expert; however, it does require that every executor fulfill their duties with the utmost honesty and attentiveness. In other words, according to law, you have a “fiduciary duty,” that as the executor, you are going to act in good faith with regards to a person’s will.

As the executor, generally you are not entitled to proceeds from the sale of any property of the estate. The executor however, is entitled to a fee as compensation for administering the will. The fees could be mandated that it be reasonable depending on the size or involvedness of the will.

Executor Definition:

To Fulfill Specific Duties; there are many obligations that an executor of a will may have to realize, depending upon the involvedness of the will and the property to be distributed.

These duties normally include but are not limited to:

Finding the assets: The executor is responsible for finding all the decedent’s assets and for keeping the assets safe until they can be appropriately dispersed to those named in the will and/or to creditors and debtors. This controlling of assets can include upon deciding which types of assets to sell as well as what kinds of assets to keep.

Winding up the deceased’s affairs: This can cover a multitude of items to be dealt with

- Canceling any/and all credit cards that may still be open

- Notifying any bank or other financial institutions about the death of the individual.

- Notifying brokerage or financial advisors overseeing investments

- Contacting the Social Security Administration if the decedent was collecting Social Security Benefits

- Contacting any and all life insurance carriers to claim death benefits to add to the assets of the estate

- Cancelling home and auto insurance carriers to cancel policies once the estate has settled or property sold

- Contacting utility companies if services are no longer needed

Locating and communicating the heirs: Locating and contacting those who have been named and who are supposed to inherit money and/or property can be a challenge at times. If the will has not been updated, people may have moved so you the executor will need to be vigilant in finding all the heirs listed. There are some cases the deceased has designated certain property/assets go directly to an individual or charity. So it is imperative that the correct heir be found.

Deciding whether or not probating the last will and testament in court is necessary: Probating a will is the process of getting a court to approve the legitimacy of the will.

Verifying that the Will has been filed in the proper probate court: This is commonly required by law even if the will does not need to be probated

Should I set up a Separate Bank Account for the Estate?

Setting up a bank account for the estate: Since it is wise not to co-mingle the Executors funds and the deceased party’s funds, the executor is typically required to keep the estate’s money separate from their own funds. Opening up a bank account in the name of the estate makes paying off creditors and the heirs so much easier and helps prove what went into the estate, came out of the estate until such time it has been completed.

Pay ongoing required payments: Monies in the estate’s bank account are used for making mortgage, insurance and any additional ongoing payments that need to be paid during the management of the will until the estate is settled with all property being sold.

Do Heirs get paid before debtors and creditors: First and foremost; all of the decedent’s debts and creditors need to be paid off before any heirs can inherit the remaining assets. The executor of the will should notify all creditors of the death of the individual and see how they wish to proceed.

Paying final income taxes: You know that there are two things certain in life – death and taxes. One of the responsibilities the executor of a will has it that they are in charge of making certain that the decedent’s income taxes are paid for the last year they were alive.

Distributing deceased’s property: If listed in the will that certain property goes to certain heirs, the job of the Executor has it to make sure that it gets to the rightful heirs and recorded that it was given to the appropriate party. If there is other property that is not named in the will, it should pass according to the laws of the State of Ohio.

If no will is in place, the party in charge is typically called the administrator and will be responsible for reviewing the state law to see who the estate’s property will pass to in “intestate succession.”

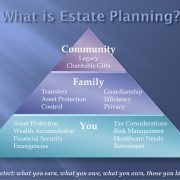

Having an Executor of your Estate is only one part to a comprehensive estate plan. For information regarding living wills, Last Will and Testaments, trusts, powers of attorney, or a pour-over will, contact Daniel A. Baron of Baron Law today at 216-573-3723.