Ohio Bypass Trusts – Cleveland, Ohio Attorney

Cleveland, Ohio Trust Attorney

Ohio Bypass Trusts

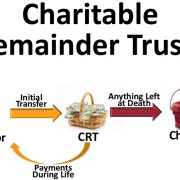

Bypass trusts, or “credit shelter” trusts, have historically been an important estate planning tool that shields probate assets against estate taxes. Most often, a bypass trust is found in your spouse’s will. Each spouse directs that if you are the first spouse to die, then your solely owned assets be used to fund the bypass trust with up to whatever personal estate tax exemption is at the time. Since 2013, the estate tax exemption is $5.25 million. After death, money is used to fund the trust. The money can come from a variety of sources including, probate assets, assets in a revocable living trust, life insurance policies, and retirement accounts. Note however, that some retirement accounts cannot avoid certain federal taxes.

For example, say Molly dies leaving her son $1 million in a 401K plan. Molly directs the money to a trust. The trustee is to pay the trust ‘income’ to the son annually, and distribute the principal to the son when he reaches age 35. The 401k plan distributes a $million lump sum to the trustee a few days after Molly’s death. Barring an unusual provision in the trust instrument or applicable state law, the entire $1 million plan distribution is considered the trust ‘corpus.’ On the federal income tax return for the trust’s first year, the trust must report $1 million in gross income. The trustee invests the money that’s left after paying the income tax on the distribution, and pays the income from the investments each year to Molly’s son.

If properly structured, assets in a bypass trust will not be included in your surviving spouse’s estate. Instead, the money will ‘bypass’ your spouse’s taxable estate at their death and pass tax free. Any amount in excess of the current federal estate tax exemption would then be distributed outright to the surviving spouse or is used to fund a marital trust or qualified terminable interest property (QTIP) trust.

Although bypass trusts have been used for years, they have become somewhat unnecessary. Since 2013, the new laws allow a surviving spouse take up to $5.25 million tax free. This is because the new laws allow this amount under the federal estate tax exemption. Thus, unless you have a fairly large amount of assets, a living will would do the trick and allow for $5.25 million to be passed on tax free.

For larger estates, bypass trusts can offer advantages. For example, growth in the assets of a bypass trust are not excluded from the gross estate of the surviving spouse and may run up against the estate tax exemption amount in effect when the surviving spouse dies. In addition, any lifetime gifts you make that are taxable will decrease your estate tax exemption amount – decreasing the amount that can be put into the trust at your death.

For more information on trusts, living wills, or other estate planning tools, call Cleveland, Ohio attorney Dan Baron at Baron Law. Baron Law provides legal representation to business owners and individuals. Call today for a free consultation at 216-573-3723. You will speak directly with a Cleveland, Ohio attorney who can help you with your legal needs.