Knowledge Is Power – Why Knowing The Difference Between Irrevocable And Revocable Trusts Is Critically Important.

Cleveland, Ohio, estate planning law firm, Baron Law LLC, Cleveland, Ohio, offers the following information on the differences between a Revocable Trust and an Irrevocable Trust. Contact Baron Law Cleveland to ask and have answered your questions on what the differences are and what would suit your needs best.

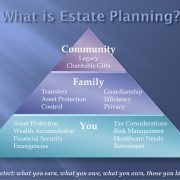

Your estate plan consists of many documents and covers a lot of bases. From protecting assets from creditors and litigants to avoiding probate where desirable, a comprehensive estate plan protects you while you’re living and provides for loved ones after death. Because estate plans are, by design, comprehensive, a lot of legal jargon is thrown around and often it’s difficult to keep track of all the nuance and detail. You can put your faith in your financial adviser or estate planning attorney and trust them completely with little or no understanding of what they’re actually doing. That certainly is an option, however, the better course is to ask questions and endeavor to remain informed as possible.

That said, one of the most common questions posed during an initial estate planning consultation is, what is the difference between a revocable and irrevocable trust? Since trusts represent one of the most utilitarian estate planning tools, they have the ability to do many useful and advantageous things in regards to estate planning, understanding the difference is critical to providing context to advice dispensed by Ohio estate planning attorneys.

- Revocable Trusts

Revocable trusts, commonly referred to as living trusts, are trusts that the grantor/settlor can change or cancel during their lifetime. The most significant aspect of living trusts is that the grantor usually keeps control over the assets placed in the living trust and, as such, receives no tax relief for those assets. Similarly, the grantor can also appoint themselves trustee of the living trust to dispense that control.

To use a simple metaphor, a trust is a treasure chest. Putting assets in the chest, the trust, protects the assets from particular threats outside and establishes rules which govern what is placed inside. The major distinguishing characteristic of living trusts is that the grantor, owner of the trust, keeps control of the key that unlocks the treasure chest and can get at what’s inside.

So, naturally, the next question after what is a revocable trust is, why would I want one? The advantages of living trusts are numerous but are highly particular to individual circumstances. An Ohio estate planning attorney is in the best position to judge what an individual’s needs are and the best ways to meet them. Generally, however, the primary advantages of using living trust are avoiding probate, directly providing for distribution of assets through trust beneficiary designations, privacy, trust inventories are not public record, and maintaining control of assets trusts during life and post-death.

- Irrevocable Trusts

Irrevocable trusts are trusts in which the grantor relinquishes all control and ownership over the trust and the assets used to fund the trust. Thus, the trust cannot be changed or canceled without the beneficiaries’ permission. Prior to trust formation, grantor can dictate whatever terms they desire to govern the trust, but after formation, those terms control independent of grantor’s wishes and desires.

So, again, why would anyone give up control and chose irrevocable trusts? As mentioned previously, with living trusts, grantors keep the key to the treasure chest. With irrevocable trusts, however, the grantor gives the key to another, namely a trustee. Since grantor no longer has the key, grantor can no longer get what’s inside the chest. Since the assets in an irrevocable trust no longer belong to grantor, at least in the eyes of the law, this has major tax and legal implications.

These tax and legal consequences are the primary advantages of irrevocable trusts, and what distinguishes revocable from irrevocable trusts. First, since control over trust assets is relinquished, the IRS does not consider trust assets to be in grantor’s taxable estate. Thus, estate, income, or gift taxes may be avoided or reduced in certain circumstances. Further, assets within an irrevocable trust enjoy protection from creditors and litigation. Of particular importance for seniors, assets within this type of trust are not counted as an asset for eligibility in Medicaid or other government assistance programs. A common tactic is to place a martial home, usually the largest asset, in trust. Thus, eligibility is maintained but the house can still be lived in. This sheltering of assets while still maintaining use is at the core of irrevocable trusts. Even though direct control is relinquished, grantors dictate the terms of the trust. Such terms often mandate to the trustee that such trust assets are used for the health, support, and maintenance of the grantors. Thus, grantors still get to enjoy and profit from assets but get the benefits of not, technically, owning such.

Naturally, the question everyone asks is which one is best. Unfortunately, as with most things financial and legal, there isn’t a straight answer. Dependent on the circumstances, such as estate planning goals, family structure, available estate assets, either or both types of trusts may be advantageous to use. A Cleveland estate planning attorney is in the best position to judge what is most appropriate for a given situation.

Regardless of which is most appropriate, the most critical part is funding your trust. Picking what type or types of trusts is best is the easy part. The hardest part, and the one most often overlooked, is properly funding a trust. More often than not, people think after creating the trust the work is done. This is patently false. A trust without proper funding isn’t worth the paper it’s printed on. If you’re asking yourself how do I fund my trust or is my trust funded, please contact an Ohio trust attorney as soon as possible. The security you though you bought with your trust is likely imaginary.

You don’t have to be rich to protect what you’ve spent a lifetime trying to build. To find out whether a trust is right for your family, take the one-minute questionnaire at www.DoIneedaTrust.com. There are a number of different trusts available and the choices are infinite. With every scenario, careful consideration of every trust planning strategy should be considered for the maximum asset protection and tax savings. For more information, you can contact Mike Benjamin of Baron Law LLC at 216-573-3723. Baron Law LLC is a Cleveland, Ohio area law firm focusing on estate planning and elder law. Mike can also be reached at mike@baronlawcleveland.com.

Helping You and Your Loved Ones Plan for the Future.

About the author: Mike E. Benjamin, Esq.

Mike is a contracted attorney at Baron Law LLC who specializes in civil litigation, estate planning, and probate law. He is a member of the Westshore Bar Association, the Ohio State Bar Association, the Cleveland Metropolitan Bar Association, and the Federal Bar Association for the Northern District of Ohio. He can be reached at mike@baronlawcleveland.com.

Disclaimer:

The information contained herein is general in nature, is provided for informational and educational purposes only, and should not be construed as legal or tax advice. The author nor Baron Law LLC cannot and does not guarantee that such information is accurate, complete, or timely. Laws of a particular state or laws that may be applicable in a given situation may impact the applicability, accuracy, or completeness of the preceding information. Further, federal and state laws and regulations are complex and subject to change. Changes in such laws often have material impact on estate planning and tax forecasts. As such, the author and Baron Law LLC make no warranties regarding the herein information or any results arising from its use. Furthermore, the author and Baron Law LLC disclaim any liability arising out of your use of, or any financial position taken in reliance on, such information. As always consult an attorney regarding your specific legal or tax situation.