Is Annuity-Based Long-Term Care Right for You?

Annuity-Based Long-Term Care and the Pension Protection Act of 2006

Medicaid and long-term care are unquestionably a hot topic. Estate planning and Medicaid planning attorneys have long been waiting for an opportunity that would allow those wishing to enroll in Medicaid to shelter all or a portion of their savings – legally! Cleveland, Ohio estate planning attorney Dan Baron offers the following information on long-term care and how the Pension Protection Act of 2006 has created one of these sought after opportunities.

In 2006, the President signed into law The Pension Protection Act of 2006 (the “Act”). The act changed certain tax laws and allows for those owning annuity contracts to take advantage of certain tax savings. In sum, the Act allows the cash value of annuity contracts to be used to pay premiums on long-term care contracts. The payment of premiums in this way will reduce the cost basis of the annuity contract. In addition, the Act allow annuity contracts without long-term care riders to be exchanged for contracts with such a rider in a tax-free transfer under Section 1035 of the Internal Revenue Code of 1986, as amended (IRC).

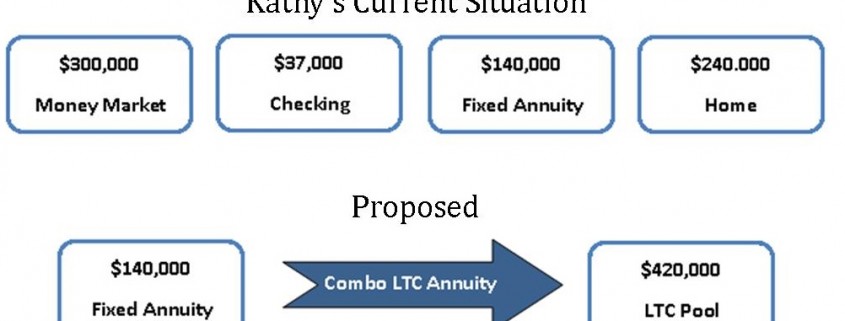

Here’s an example of how the Act’s changes might benefit someone considering long-term care insurance. Let’s say that Kathy, age 70, lives in Cleveland. Her children live out of state but are concerned with a recent diagnosis of diabetes, along with a history of heart disease. Because of these illnesses, she was not a good candidate for traditional long-term care insurance. However, by taking advantage of an annuity based long-term care strategy that takes advantage of the Pension Protection Act, Kathy could likely be insured.

Look at the illustration below. Kathy can take her $140,000 fixed annuity with a cost basis of only $40,000 (i.e. the amount she actually deposited) and using the tax-free exchange from his existing fixed annuity to a new annuity that complied with the Act’s rules, Kathy’s $140,000 fixed annuity could continue to earn interest. However, if she needed long-term care to pay for home care, assisted living, or skilled care, she now had a long-term care pool of money equal to $420,000.

- Kathy retains her $140,000 in cash value plus an additional $280,000 for a total of $420,000 for long-term care.

- Her benefits may be used for home care, assisted living, and skilled care.

- She pays no annual premiums

- As her annuity grows, so does her LTC. (assuming she does not use her LTC benefits)

There are many annuity based long-term care packages available. It’s best to consult with an attorney or Medicaid specialist who can help you choose the right plan. For more information, or to speak with Cleveland estate planning and Medicaid planning attorney Dan Baron, contact our office at Baron Law LLC. Baron Law LLC is a Cleveland, Ohio law firm dedicated to helping those in need of elder care, estate planning, and Medicaid planning. Contact attorney Dan Baron today at 216-276-4282.