Estate and Trust Planning Services

Are you prepared for the future?

According to a recent survey, as many as two-thirds of American adults don’t have even a will.

You may think not having an estate plan is the same as having no plan at all. But passing away without a will or trust, also called dying “intestate,” leaves your family at the mercy of the state’s plan and can cost thousands in court fees or unplanned distributions.

We explore the basics of estate and trust planning, and the reasons to seek out the services of an experienced estate planning attorney.

What Are Trust and Estate Planning Services?

Estate planning is the implementation of a plan for how an individual’s assets will be managed and distributed after their death—usually through the creation of legal documents like wills and trusts. In many cases, the process also involves creating an asset protection trust plan to minimize any possible financial burden and naming an individual to make medical or financial decisions on your behalf should you become incapacitated or unable to make them yourself.

What Are Some Types of Estate Planning Documents?

Your comprehensive estate plan will consist of at least one legal document. While estate planning usually takes the form of a will or trust, there’s no one-size fits all solution—an estate planning law firm will help you determine the right strategy for your specific situation.

Your estate planning attorney may recommend an estate plan like:

- Wills: The simplest form of an estate plan, a will spells out how your assets will be dispersed and names an executor (a person tasked with administering the will’s instructions). Note that a will, aka last will and testament, does NOT avoid the probate court. All wills must be administered through probate court.

- Revocable Trusts: A document that lays out how your assets should be divided while also giving you control over your estate even after you have passed. Trusts are considered the “gold standard” for estate planning because unlike a will, they can establish guardianship, do more to protect assets, and aren’t required to pass through probate.

- Asset Protection Trusts: A tool used to protect assets, in particular your home, from a nursing home. This type of trust is usually implemented once a person is over sixty-five years of age.

- HIPPA authorizations: Grants loved ones the ability to obtain your health care records on your behalf.

- Guardianships: Establishes a guardian to oversee the legal and financial affairs of an individual or their children when that person is no longer able to care for or protect themselves.

- Living will: Different from a standard will, a living will details your health care preferences in the event that you are incapacitated and unable to live without assistance from medical devices.

- Financial Power of Attorney: Gives your loved ones the ability to make financial decisions on your behalf should you become unable to.

- Healthcare Power of Attorney: Gives your loved ones the ability to make healthcare decisions on your behalf.

Because it can help avoid probate court and better protect your assets, we generally recommend a trust over a will.

Do You Need a Trust?

Who Should Create an Estate Plan

Contrary to popular belief, estate planning isn’t just for the wealthy. An estate plan is important for anybody with an estate—which is almost everyone!

Your estate is made up of everything that comprises your net worth, and includes:

- Real estate and land

- Belongings and collectables

- Financial investments

- Life insurance policies

When to Create an Estate Plan

It may sound surprising, but most experts recommend setting up an estate plan as soon as you enter legal adulthood! The right estate and trust planning attorney can make the process easy. A will (the bare minimum estate planning document) typically takes only a few hours to set up—so there’s no reason to wait.

How Often Should You Review Your Estate Plan?

It’s generally recommended that you review your estate plan at least every five years, or when major life events occur.

These can include:

- Marriage or divorce

- The birth of a child or grandchild

- A child entering adulthood

- Purchase of real estate or other major assets

- Receiving a large inheritance

How to Prepare For Your Meeting With an Estate Planning Law Firm

Making the right plan for your family’s future is an important step. When preparing to meet with an estate planning law firm, it’s best to:

- Identify your goals, whether you’re focused on protecting your assets, providing for loved ones, or reducing your estate tax burden (or all of the above).

- Make a list of your assets, including real estate, possessions, investments, insurance policies, and anything else that comprises your net worth. Your financial advisor or tax advisor may be able to help.

- Talk with your loved ones about the arrangements you plan to make, especially if you are listing them as a guardian or administrator.

Northern Ohio’s Estate Planning Law Firm

With a combined 60+ years of experience in the Ohio legal community, Baron Law LLC has the expertise to help you make sure your assets are protected. And whether it’s free seminars, community college classes, or journal articles, we always remain plugged into our community—we have offices in Independence, Westlake, Beachwood, and Columbus Ohio.

A comprehensive estate planning strategy involves the whole family. At our firm, we bring your family members and loved ones into the process, and keep them informed at every stage.

Partner with Baron Law, LLC estate planning lawyers to get started on a comprehensive plan for your future today.

Fill out our contact form below or call us (216) 573-3723 to set up an appointment.

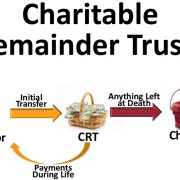

Leaving a Legacy While Saving on Taxes Through Charitable Gifting

Leaving a legacy to charity is a great way to support your community, make an impact, and save on taxes. There are many charitable estate planning strategies to consider and each one comes with a careful consideration.

COVID-19 Funeral Reimbursement

Did you know that you can be reimbursed for the funeral expenses of a lost loved one that passed from COVID-19? COVID-19 has affected the lives of many Americans and their families, reimbursement of funeral costs is a little way to ease the grief of losing a loved one from this pandemic. The Federal Emergency […]

Five Reasons Why Having a Family Trust is Better Than a Simple Will

When planning for your loved ones, one common misunderstanding is thinking that you have to be ultra-wealthy to need or benefit from a trust. While a common misconception, a lack of knowledge in this area can be costly. Even if your estate is fairly small, you still want to avoid the high costs and inefficiency […]

Top Reasons Why You Should Avoid Probate

Whether it was a gathering for a joyous wedding or the passing of a loved one, we’ve all heard about Probate Court at some point or another. We are going to dive into what probate is and why you want to avoid it when it comes to your estate, if you have no plan. First, […]

Baron Law LLC Now Hiring Paralegals and Office Admin.

Baron Law LLC is currently hiring paralegals and office management. Details for this position are detailed below. Hours: 20-30 per-week Pay: $20.00 – $32.00 per-hour depending on experience. Remote Workplace: Applicant would be able to work remotely most of the time while coming into the Independence office as needed. During the temporary pandemic, the office […]

COVID-19 and the Continuing Importance of Powers of Attorney

Certainty in this uncertain time is peace of mind many families are finding themselves without. The Covid-19 pandemic is highlighting harsh realities of life all of us were aware of but chose to ignore. One such reality is the importance of comprehensive and up-to-date estate planning. Many parents, grandparents, established business owners, and seasoned professionals […]

GST: Generation Skipping Transfer Tax

Staying abreast of current tax changes is critical to getting the most “bang for your buck” when it comes to estate planning. 2018 had significant, albeit likely temporary, increases in the federal estate, gift, and generation-skipping transfer tax exemptions. For example, individuals who previously used their previous lifetime gift tax exemption amounts can now effectively […]

Can I Put My House In A Trust If It Has A Mortgage?

More and more people are becoming ever more concerned with either protecting their assets, maintaining eligibility for Medicaid, or leaving as much as possible to children and future grandkids. As such, more and more people are realizing the remarkable utility of trusts within their estate planning. One’s residence often represents the most significant asset an individual […]

Advanced Directives and Your Estate Planning

What are Advanced Directives? Advance directives are a set of documents where you are appointing another individual to make medical decisions on your behalf. Typically, we have in these documents a living will, HIPPA authorization, and then health care power of attorney. How Are These Documents Used? Living Will- A living, will not to be […]

D.I.Y. Estate Planning: Saving a Dollar Now, Lose a Thousand Later

D.I.Y. Estate Planning: Legal Zoom, Rocket Lawyer, and Youtube has granted an unprecedented amount of legal information to the public. Online forums, blogs, and television allow people to converse at any time and anywhere about pretty much anything. Nowadays ordinary people can undertake their own legal research, legal drafting, and, if necessary, personal representation. Just […]

Guardianship and Your Estate Planning

What is Guardianship? A guardianship is where a person has the legal authority to care for another. Are There Different Types of Guardianships? Minor Children-The most common type of guardianship is with minors. If something happens to children under the age of 18, then you need someone to act as a parent. A misconception is […]

Financial Power of Attorney | Baron Law | Cleveland, Ohio

Financial power attorney (POA) is a set of documents that you’re giving your agent the ability to act and make financial decisions on your behalf. They’re most commonly used in an elder law scenario. They can also be used in a crisis scenario, if you are overseas, a business owner, and you need to elect […]

Preventing Children From Blowing Through Their Inheritance

Blood is thicker than water and we get to pick our friends, not our families. There are a lot of pithy and whimsical sayings that have been passed down through the generations that attempt to explain and characterize the complex and often contradictory nature of family relations. When it comes to deciding who gets the […]

What is the Difference Between a Trust and a Will in Estate Planning?

What is a Will? A will is a basic document outlining your wishes for your estate. It identifies an executor of your estate and provides the opportunity to divide your assets among your beneficiaries. This tool allows you to control the future care for any minor children and division of your assets. Without a will, […]

The Three Flavors of Special Needs Trusts: #3 Self-Settled Trusts

The federal “Special Needs Trust Fairness Act,” enacted in December of 2016, changed the law to allow individuals with special needs to create their own special needs trust. Ohio law, in response, has changed to coincide with this recent change. Currently, a mentally or physically disabled person may create a self-settled trust to hold their […]

The Three Flavors of Special Needs Trusts: #2 Pooled Trusts

Baron Law LLC, Cleveland, Ohio, offers information for you to reflect upon while you are setting out looking for an estate planning attorney to help protect as much of your assets as you can. For more comprehensive information contact Baron Law Cleveland to draft your comprehensive estate plan to endeavor to keep more of your […]

The Three Flavors of Special Needs Trusts: #1 Third-Party Trusts

Estate Planning law firm Baron Law Cleveland offers the following part 1 of a three part series of explaining the difference trusts available for those who have loved ones with Special Needs. Dan Baron of Baron Law can advise what is best trust for your situation as the trusts are as individual as your loved […]

Why Do I Need a Family Trust as Part of My Estate Planning?

At Baron law, we help you and your loved ones plan for the future. We provide legal advice in estate planning, real estate, business law, divorce, and landlord/ tenant law. One of the most important ways that we help you plan for the future is with family trusts. What is a Family Trust? A family […]

Unique Needs, Unique Solution: Supplemental Services Trusts

As with most persons with special needs and disabilities, the name of the game is to pay it forward. Unplanned and unthought out self-sacrifice, however, are rarely the proper ways to go about anything. Unfortunately, those families with loved ones with particularly debilitating diseases or affiliations are often solely focused on the here and now […]

What Is The Difference Between A Living And Testamentary Trust?

Your estate plan consists of many documents and covers a lot of bases. From protecting assets from creditors and litigants to avoiding probate, a comprehensive estate plan protects you while you’re living and provides for loved ones after death. Because estate plans are, by design, comprehensive, a lot of legal jargon is thrown around and […]

Thinking Of Giving To A Charity? Consider A Charitable Remainder Trust.

Significant and stable retirement income, reduction in taxes, whether income, capital gains, or estate respectively, and the provision of critical needed support for worthy charitable organizations and endeavors. If any, or all, of these sound good to you and your estate planning goals, charitable remainder trusts might be a useful option. Charitable remainder trusts, not to be confused with charitable lead trusts, is a way […]

Common Questions With Inherited IRA’s

Most of us don’t have millions of dollars in liquid assets to fund our retirements. Ordinary people use common investment tools such as traditional IRAs, Roth IRAs, simplified employee pension plans (“SEPs”), and savings incentive match plans for employees (“SIMPLE IRAs”) to pay for healthcare and living expenses in old age. The main goal for […]

Are Your Parents in a Nursing Home? Here Are Ways to Prevent Medicaid Estate Recovery

Medicaid crisis planning has become a hot topic in estate planning. More people need Medicaid to survive the issues and problems of old age but very few actually take the time to address and plan for this all too important need. Contrary to popular belief, Medicaid is not free money. Medicaid is a needs based […]

Planning for Crisis: Advance Directives

Estate planning is an expansive concept. Fundamentally, estate planning seeks to create a detailed plan for your finances, healthcare, and assets for the reminder of life and after death, to the extent physically possible and within the means of the estate planner. Though it would be nice if a crystal ball existed and told us […]

Divorcing Late In Life? Estate Planning Considerations You Need To Know.

Unfortunately, “till death do us part” doesn’t seem to have the same weight or meaning that it had back in the day. Per the American Psychological Association, more than 90 percent of people marry by the age of 50, however, more than 50 percent of marriages end in divorce. Further, the divorce rate for subsequent marriages […]

What is an Irrevocable Trust?

Cleveland, Ohio estate planning lawyer, Daniel A. Baron, offers the following information as to whether or not you should have an Irrevocable Trust as part of your comprehensive estate planning. An Irrevocable Trust, by design cannot be modified in any fashion or terminated without the express written consent of the beneficiary or beneficiaries. Once the […]

What Is A Revocable Trust?

Cleveland, Ohio estate planning lawyer, Daniel A. Baron, offers the following information as to whether or not you should have a Revocable Trust as part of your comprehensive estate planning. When you decide it is time to do your estate planning, one decision to make is: Do I Need A Trust? If the answer is […]

529 Plan For Your Grandchildren

Baron Law LLC, Cleveland, Ohio, offers information for you to reflect upon while you are setting out looking for an estate planning attorney to help protect as much of your assets as you can. For more comprehensive information contact Baron Law Cleveland to draft your comprehensive estate plan to endeavor to keep more of your […]

Common Reasons Why Family Trusts Are Important

Baron Law LLC, Cleveland, Ohio, offers information for you to reflect upon while you are setting out looking for an estate planning attorney to help protect as much of your assets as you can. For more comprehensive information contact Baron Law Cleveland to draft your comprehensive estate plan to endeavor to keep more of your […]

Terminating Irrevocable Trusts I: Changing What Can’t Be Changed

Baron Law LLC, Cleveland, Ohio, offers information for you to reflect upon while you are setting out looking for an estate planning attorney to help protect as much of your assets as you can. For more comprehensive information contact Baron Law Cleveland to draft your comprehensive estate plan to endeavor to keep more of your […]

How To Use An Ohio Legacy Trust To Protect Family Assets

Baron Law LLC, Cleveland, Ohio, offers information for you to reflect upon while you are setting out looking for an estate planning attorney to help protect as much of your assets as you can. For more comprehensive information contact Baron Law Cleveland to draft your comprehensive estate plan to endeavor to keep more of your […]

How Do I Force A Trustee To Tell Me What’s In A Trust?

Baron Law LLC, Cleveland, Ohio, offers information for you to reflect upon while you are setting out looking for an estate planning attorney to help protect as much of your assets as you can. For more comprehensive information contact Baron Law Cleveland to draft your comprehensive estate plan to endeavor to keep more of your assets […]

A Trust Unfunded Is Just Paper And Ink, The Importance Of Funding Your Trust,

Baron Law LLC, Cleveland, Ohio, offers information for you to reflect upon while you are setting out looking for an estate planning attorney to help protect as much of your assets as you can. For more comprehensive information contact Baron Law Cleveland to draft your comprehensive estate plan to endeavor to keep more of your […]

T.O.D. Designations to Avoid Probate

Baron Law LLC, Cleveland, Ohio, offers information for you to reflect upon while you are setting out looking for an estate planning attorney to help protect as much of your assets as you can. For more comprehensive information contact Baron Law Cleveland to draft your comprehensive estate plan to endeavor to keep more of your assets […]

Trustees – Part II: Duty To Keep Adequate Records

Baron Law LLC, Cleveland, Ohio, offers information for you to reflect upon while you are setting out looking for an estate planning attorney to help protect as much of your assets as you can. For more comprehensive information contact Baron Law Cleveland to draft your comprehensive estate plan to endeavor to keep more of your assets […]

Trustees – Part I – You’re Named A Trustee, What Duties Do you Have?

Baron Law LLC, Cleveland, Ohio, offers information for you to reflect upon while you are setting out looking for an estate planning attorney to help protect as much of your assets as you can. For more comprehensive information contact Baron Law Cleveland to draft your comprehensive estate plan to endeavor to keep more of your assets […]

Why Avoid Probate: Asset Valuation Expense

Cleveland, Ohio, estate planning law firm, Baron Law LLC, Cleveland, Ohio, offers information for you to reflect upon while you are setting out looking for an estate planning attorney to help protect as much of your assets as you can. For more comprehensive information contact Baron Law Cleveland to draft your comprehensive estate plan to endeavor […]

How Can I Amend An Existing Will?

Cleveland, Ohio, estate planning lawyer, Daniel A. Baron, Ohio, offers the following information on what documents are necessary for you to provide your attorney when sitting down to establish your comprehensive estate plan. One of the primary goals of drafting a will is to encapsulate the entirety of a life’s material assets and leave instructions […]

Dying Without A Will – A Mess for Your Family To Clean-up

Baron Law LLC, Cleveland, Ohio, offers information for you to reflect upon while you are setting out looking for an estate planning attorney to help protect as much of your assets as you can. For more comprehensive information contact Baron Law Cleveland to draft your comprehensive estate plan to endeavor to keep more of your […]

I’ve Changed My Mind, How Do I Modify Or Revoke My Trust?

Baron Law LLC, Cleveland, Ohio, offers information for you to reflect upon while you are setting out looking for an estate planning attorney to help protect as much of your assets as you can. For more comprehensive information contact Baron Law Cleveland to draft your comprehensive estate plan to endeavor to keep more of your […]

What Is An Estate Plan, Part II – Life Documents?

Baron Law LLC, of Cleveland, Ohio, offers the following information on different components of an Estate Plan. To see what plan is best suited for your needs, contact Baron Law, LLC, Cleveland, Ohio In a previous post, last will and testaments, guardianships, and letters of intent were explored. These documents however, only provide a partial […]

What Is An Estate Plan, Part I – Death Documents

Baron Law LLC, of Cleveland, Ohio, offers the following information on different components of an Estate Plan. To see what plan is best suited for your needs, contact Baron Law, LLC, Cleveland, Ohio Estate planning is a concept that many people know about, but few fully understand. To most, planning an estate consists simply of […]

What is Probate?

Cleveland, Ohio, estate planning law firm, Baron Law LLC, Cleveland, Ohio, offers information for you to reflect upon while you are setting out looking for an estate planning attorney to help protect as much of your assets as you can. For more comprehensive information contact Baron Law Cleveland to draft your comprehensive estate plan to endeavor […]

You Have Been Appointed Executor, What Do You Do?

Cleveland, Ohio, estate planning lawyer, Daniel A. Baron, Ohio, offers the following information on what your duties are as an executor of an estate. Contact Daniel A. Baron of Baron Law to answer all your questions on what your duties are and to help guide you through the events that will be taking place and […]

Executor’s Duties – When Should Debts Be Paid?

Cleveland, Ohio, estate planning law firm, Baron Law LLC, Cleveland, Ohio, offers the following information on what your duties are as an executor of an estates and when you need to pay all debts of the estate. Contact Baron Law Cleveland to answer all your questions on what your duties are and to help guide your through […]

I’ve Been Named As The Executor In A Will, Now What?

Cleveland, Ohio, estate planning law firm, Baron Law LLC, Cleveland, Ohio, offers the following information on what your duties are as an executor of an estate. Contact Baron Law Cleveland to answer all your questions on what your duties are and to help guide your through the upcoming events which are about to occur and how to […]

Spousal Rights – Are You Forced To Take What Is Bequeathed?

Cleveland, Ohio, estate planning law firm, Baron Law LLC, Cleveland, Ohio, offers the following information on how to handle your spouses will after they pass. Are you forced to take what is left to you? Contact Baron Law Cleveland to answer this question and any other questions you may have on wills and probate. Humans are […]

Procedures To Shorten Or Avoid Probate Of An Estate

Cleveland, Ohio, estate planning lawyer, Daniel A. Baron, Ohio, offers the following information on what types of probate procedures shorten or avoid the need to probate and estate when speaking with your attorney when you are establishing your comprehensive estate plan. When an individual dies, their “probate assets,” such as property not dispensed via beneficiary designations, transfer on […]

Knowledge Is Power – Why Knowing The Difference Between Irrevocable And Revocable Trusts Is Critically Important.

Cleveland, Ohio, estate planning law firm, Baron Law LLC, Cleveland, Ohio, offers the following information on the differences between a Revocable Trust and an Irrevocable Trust. Contact Baron Law Cleveland to ask and have answered your questions on what the differences are and what would suit your needs best. Your estate plan consists of many documents and […]

Estate Planning – Documents I Should Provide My Attorney

Cleveland, Ohio, estate planning lawyer, Daniel A. Baron, Ohio, offers the following information on what documents are necessary for you to provide your attorney when sitting down to establish your comprehensive estate plan. “Be prepared.” Boy Scouts of America A recent survey taken by the AARP found that 3 out of every 5 Americans have no […]

Probate Is Expensive And Time-Consuming. Here Are Ways To Avoid Probate

Cleveland, Ohio, estate planning law firm, Baron Law LLC, Cleveland, Ohio, offers the following information on you can avoid probate when you are thinking of establishing your comprehensive estate plan. All too often people draft a last will and testament, shove the document in a safety deposit box at the local bank, and never give it […]

What Is An Estate Plan, Part I – Death Documents?

Baron Law LLC, of Cleveland, Ohio, offers the following information on different components of an Estate Plan. To see what plan is best suited for your needs, contact Baron Law, LLC, Cleveland, Ohio. By failing to prepare, you are preparing to fail.” Benjamin Franklin Estate planning is a concept that many people know about, but […]

Attorney Dan A. Baron Writes Feature Article for Cleveland Metropolitan Bar Journal

With the passing of American Taxpayer Relief Act of 2012 (ATRA), P.L. 112-240 clients now have broader power to save on federal estate taxes. Significant expansion of the federal estate tax exclusion has dramatically changed how estate planning professionals plan for married couples. In 2000 when the federal estate tax exclusion was merely $675,000 and […]

Qualified Personal Residence Trusts

Cleveland, Ohio, estate planning lawyer, Daniel A. Baron, Ohio, offers the following information on whether a Qualified Personal Residence Trust should be part of your comprehensive estate planning. For wealthier families, a great tool to manage your future tax savings would be to transfer the liability of owning a property for which you may end […]

Planning for Married Couples Using Portability and Bypass Trusts

Planning for Married Couples Using Portability and Bypass Trusts As Seen Published in the Cleveland Metropolitan Bar Journal Significant expansion of the federal estate tax exclusion has dramatically changed how estate planning professionals plan for married couples. In 2000 when the federal estate tax exclusion was merely $675,000 and federal tax rates peaked at fifty-five […]

Ohio’s Right to Disposition – Who Has Final Say?

Cleveland, Ohio, Estate Planning lawyer, Daniel A. Baron, of Cleveland, Ohio, offers the following information on the issue of your Rights to Disposition after you pass. Imagine if you will, your Uncle Harry has passed away and although he had specific wishes on what to do with his remains, there are others in a packed […]

Irrevocable Life Insurance Trust – Is It Right For You?

Cleveland, Ohio, Estate Planning lawyer, Daniel A. Baron, of Cleveland, Ohio, offers the following information on establishing an Irrevocable Life Insurance Trust (ILIT). Is it the right fit for you when creating your estate plan? When you think about life insurance, you typically are going to use this as a vehicle to plan for the […]

Do I need a Trust?

Exploring whether you need a trust may be answered below visiting this questionnaire: DoIneedaTrust.com. In addition, you may find the following information written by Cleveland, Ohio estate planning lawyer Daniel A. Baron useful. Even if your name isn’t Bill Gates or Warren Buffet, it does not necessarily mean that the need for you to establish […]

What Is A Credit Shelter Trust?

Cleveland, Ohio estate planning lawyer, Daniel A. Baron, of Cleveland, Ohio, offers the following information on what a Credit Shelter Trust is and should it be part of your comprehensive estate planning. If you are married and an investor, for example, consider establishing a Credit Shelter Trust. This can also be referred to as an […]

Why Do I Need A Guardianship?

Cleveland, Ohio, Estate Planning and elder law attorney, Daniel A. Baron, offers the following information on creating a Children’s Testamentary Trust for your loved ones. Is it the best option for you when creating your estate plan? Most people understand and realize that they should name a Legal Guardian for their minor children. However, many […]

Why Every Parent Should Establish A Guardianship Within Their Estate Plan

Cleveland, Ohio estate planning lawyer, Daniel A. Baron, offers information on why every parent should establish a guardianship for their minor children within their estate plan: When is a guardianship necessary? It is customary for the parents of minor children to make any and all legal decisions that are necessary to keep their children […]

When is a Legal Guardianship Necessary for my Parents?

Cleveland, Ohio estate planning attorney, Daniel A. Baron, offers information on when it becomes necessary to change legal guardianship for your elderly loved one: Legal Guardianship is used when a person is unable to make or make sound decisions about themselves personally or their property. These same persons can likely be or already have been […]

The Importance of an Elder Law Attorney

Cleveland, Ohio estate planning attorney, Daniel A. Baron, offers information on the importance of having an Elder Law Attorney to help plan for your future: Elder law attorneys are sometimes considered “authorities” as, although they can handle a wide range of other legal issues, they primarily focus on the needs of older adults and also […]

When Should You Start Planning For Long Term Care?

Cleveland, Ohio estate planning attorney, Daniel A. Baron, offers information on when you should start planning for Long Term Care and including this as part of your Estate Planning: When should you start planning for Long Term Care? If you are under 50, the answer is – “there is no time like the present”. […]

AN AB Trust – What are the benefits for your estate?

Cleveland, Ohio estate planning attorney, Daniel A. Baron, offers information on an AB Trust and the benefits realized from including this as part of your Tax and Estate Planning: For Tax and Estate Planning purposes, as a married couple, maximize the use of your Federal Estate Tax Exemptions through the utilization of an AB Trust. […]

Applying for Medicaid? Here’s What You Need to Know About Activities of Daily Living vs. Instrumental Activities of Daily Living

Cleveland, Ohio estate planning and elder law attorney, Daniel A. Baron, offers the following information on the definition of ADL’s and IADL’s and how to plan on Long Term Care as part of your Estate and Medicaid Plan: As we are all well aware, there is only one alternative to aging. If you are fortunate […]

The Definition and Role of an Executor of an Estate

Cleveland, Ohio estate planning attorney, Daniel A. Baron, offers the following information on the Definition and Role of an Executor of your Estate. Being named and then carrying out the duties of an executor can be one of life’s most frightening tasks however; keep in mind that this is also an honor. Being named […]

I Recently moved to Ohio from another State? Do I Need To Update My Power of Attorney?

Cleveland, Ohio estate planning attorney, Daniel A. Baron, offers the following helpful answers to Powers of Attorney: What If I have a Power of Attorney From another state? Most Powers of Attorney signed in other states will be recognized in the other states. A Power of Attorney used to convey title to real estate, typically […]

Grantor vs Non-Grantor Trusts

Cleveland, Ohio estate planning attorney, Daniel A. Baron, offers information on the differences between and Grantor and a Non-Grantor Trusts and further considerations to as part of your Tax and Estate Plan: Understanding tax benefits and pitfalls of a trust and putting together a trust which is most beneficial for your personal situation is best […]

Incorporating Long Term Care to Avoid Accidents and Falling

Cleveland, Ohio estate planning and elder law attorney, Daniel A. Baron, offers the following information on Long Term Care and incorporating it into your Estate Planning: If you are over aged 65, a fall could leave you incapacitated or worse, it could be fatal. Having a Non-fatal fall could leave you unable to care for […]

The Marital Deduction – What are the benefits?

Cleveland, Ohio estate planning attorney, Daniel A. Baron, offers information on The Marital Deduction as well as other Tax Planning Advice and what to make part of your Estate Planning. What are the benefits? The most important deduction a married couple has is the The Marital Deduction. The amount of assets which can be passed […]

QDOT – What is it and should I have one?

Cleveland, Ohio estate planning attorney, Daniel A. Baron, offers information on a Qualified Domestic Trust and the benefits realized from including this as part of your Tax and Estate Planning: The specific goal of a Qualified Domestic Trust (or QDOT) is to defer Federal Estate Tax on assets which are transferred from a […]

What is a Trust Protector?

Cleveland, Ohio estate planning attorney, Daniel A. Baron, offers information on a Trust Protector and their Role and benefits realized as part of your Comprehensive Estate Plan: Who is a Trust Protector? As it sounds, a Trust Protector is appointed to oversee the assets in the trust and to protect against the trustees so that […]

What Recourse Do I Have if My Power of Attorney is Stealing From Me?

Cleveland, Ohio estate planning attorney, Daniel A. Baron, offers the following helpful answers to Powers of Attorney: Can the Power of Attorney be used by the agent to take my money or property without my permission? Unfortunately, you can run the risk that the agent you choose to give your Power of Attorney could abuse […]

What’s the Difference Between a Living Will and Last Will and Testament?

Cleveland, Ohio estate planning attorney, Daniel A. Baron, offers the following helpful answers to your questions about the difference between a Living Will and a Last Will and Testament. Confusing these terms happens quite frequently as there are those that think that these are one in the same, however, they are entirely two distinct legal […]

Do I need a Living Will?

Cleveland, Ohio estate planning attorney, Daniel A. Baron, offers the following regarding living wills: Before you can answer this question you must first understand what a Living will is and what purpose it serves. A Living Will is one form of Advance Directive which clearly defines your wishes for medical care should the following occur: […]

What Is a Power of Attorney and Do I Need One?

Cleveland, Ohio estate planning attorney, Daniel A. Baron, offers the following helpful answers to Powers of Attorney: What is a Power of Attorney? A Power of Attorney is a legal document you use allowing another designated person, of your choosing, to act on your behalf. It is a legal relationship in which you are the […]

What is Business Succession?

Whether you’re planning for retirement or the life of your business after your death, it’s imperative to develop a business succession plan to sooner rather than later. There is no “one plan fits all” when it comes to developing a succession plan for your business. And given that the economy is constantly changing, it isn’t […]

Business Succession Options

Cleveland, Ohio business succession attorney Dan Baron offers the following on estate planning and business succession: You’ve spent a lifetime building your business and now its time for retirement. Where do you start? When developing your business succession plan, it’s important to consider all of your options. Selling and/or transferring your business will have […]

Revocable Living Trusts

Cleveland Estate Planning and Trust Attorney Dan A. Baron Offers the Following on Revocable Living Trusts: Revocable living trusts are used to control assets left to beneficiaries after the death of the creator. Unlike testamentary trusts which are funded after the death of the testator, revocable living trusts are funded during the trustmaker’s lifetime. Because […]

QTIP Trusts – Estate Planning for Those With Children From a Prior Marriage.

Cleveland, Ohio Estate Planning and Elder Law Attorney offers the following: The main benefit of a Qualified Terminable Interest Property Trust is being able to control your estate after your gone. In addition, there are several tax advantages for larger estates. Each spouse can set up a QTIP trust, leaving assets to the other in […]

Testamentary Trusts

Cleveland, Ohio Estate Planning Attorney Dan A. Baron offers the following on Testamentary Trusts. Testamentary trusts are a great way to plan and safeguard your assets for minor children. In other uses testamentary trusts can be used for beneficiaries with addictions or disabilities. Unlike most trusts, testamentary trusts are incorporated into your last will and […]

Difference Between a Trustee and Executor Within a Testamentary Trust

Cleveland, Ohio Estate Planning Dan A. Baron Explains the Difference Between an Executor and Trustee: Estate planning can be complicated and sometimes difficult to bear when charged with the responsibility as executor or trustee of an estate. If you have minor children, then you probably have set up some form of testamentary trust coupled with […]

Utilizing “QTIP” Trusts for Families in Second Marriages

Utilizing “QTIP” Trusts for Families in Second Marriages Estate planning in second marriages can be especially complicated when trying to secure the well-being of loved ones from a previous marriage. Much of the complexity arises from rights granted to a surviving spouse. In Ohio, spouses (male or female) are entitled to dower and elective share […]

How Will Trump’s Presidency Affect Your Trust?

How will Trump’s Presidency Affect Your Trust? With the impending inauguration of Donald Trump as our nation’s president, we would all be wise to prepare for a more conservative economic landscape that will likely include the elimination of some gift and estate taxes, lower overall rates, and new deductions. Particularly, if Trump moves forward to […]

Advantages of Establishing a Trust

There are many estate planning tools out there. But simply put, a trust is an estate planning tool that allows you to plan in advance. A trust allows you to control your assets even after your death and may allow for certain tax advantages as well as privacy and the avoidance of probate. There are […]

New Changes in Ohio’s Power of Attorney Laws

If you’re an Ohio resident concerned with the medical care of a loved one, you should be familiar with Ohio’s laws regarding power of attorney. A financial power of attorney, also known as a durable power of attorney, is a legal document an individual (the “principal”) can use to appoint someone (the “agent”) to act […]

How Do I Avoid Probate?

Successful Probate Avoidance Strategies If saving time, money, and court supervision is right for your family, then avoiding probate is right for your estate plan. There is a common misconception that having a will avoids probate. This is completely false. Having a will does NOT avoid probate. There are however many simple ways to avoid […]

Client Review

Daniel Baron reviewed our Trust, Wills and HPOA. He provided good feedback as to what needed updating and any necessary additions to the documents. We didn’t have a FPOA which thanks to him we now have. He was able answer any questions we had and proved to be very flexible to accommodate our schedules when […]

Estate Planning Solution of the Week: Health Care Proxy

Estate Planning Solution of the Week: Health Care Proxy What is a Health Care proxy? How does that differ from a health care agent? And what is the distinction between a health care proxy and a medical power of attorney? The quickest answer is that all three terms are used to refer to someone who […]

Changes in Ohio Power of Attorney Laws

Changes in Ohio Power of Attorney Laws If you’re an Ohio resident concerned with the estate plan or medical care of a loved one, you should be familiar with Ohio’s laws regarding power of attorney. Cleveland, Ohio estate planning attorney Dan A. Baron offers the following: What is a financial power of attorney? A financial […]

Springing and Durable Power of Attorney – What’s the Difference?

Springing and Durable Power of Attorney – What’s the Difference? When planning for retirement and your estate plan, it’s important to understand how your power of attorney works. Generally, there are two kinds: springing and durable power of attorney. A springing power of attorney takes affect if you become incapacitated. In comparison, a durable power […]

What is a Trust?

Cleveland, Ohio Trust Attorney What is a trust? What is the difference between a revocable trust and an irrevocable trust? Why might my estate plan include either one? Simply put, a trust helps manage your assets and provides clarity for the future. A trust is a tool that may be used to achieve your financial […]

Estate Planning – Trends Following the American Taxpayer Relief Act.

Estate Planning – Trends Following the American Taxpayer Relief Act. A recent survey concluded that sixty percent of Americans are afraid they will outlive their retirement. Thus, there has been a moving trend that people are more concerned about wealth preservation compared to wealth transfer. For example, a fifty year-old man in the top income […]

Ohio Bypass Trusts – Cleveland, Ohio Attorney

Cleveland, Ohio Trust Attorney Ohio Bypass Trusts Bypass trusts, or “credit shelter” trusts, have historically been an important estate planning tool that shields probate assets against estate taxes. Most often, a bypass trust is found in your spouse’s will. Each spouse directs that if you are the first spouse to die, then your solely owned […]

Debt after Death – What Every Family Member Should Know

Cleveland, Ohio Probate Attorney Debt after Death – What Every Family Member Should Know You come home one day to find a letter from a credit card company demanding $5,000 for the debt of your late husband. The credit card company demands payment and threatens to take legal action against you if the debt is […]

Can Lawyers Draft Wills for Out-of-State Residents?

Cleveland, Ohio Estate Planning Attorney Perhaps for most estate planning attorneys, the relationships built among clients can last for decades. Because of the duration of the relationship, it’s not unusual for an estate planning attorney to receive requests for legal assistance from clients who have changed their residence to a state in which the attorney […]

Living Trusts vs. Testamentary Trust

Living Trusts vs. Testamentary Trusts Cleveland, Ohio Estate Planning Attorney Dan Baron: If you’re planning for your Ohio estate plan, then you’re probably lost among the many estate planning terminologies. However, there are numerous estate planning methods to provide safety and security for your family. There are many ways to achieve this including living trusts, […]

Estate Planning – Protecting your Children Through Testamentary Trusts

From Cleveland, Ohio Estate Planning Attorney Dan Baron: Estate planning attorneys will tell you that testamentary trusts are a great way to protect your children and plan for your estate. Below are 10 things to know about testamentary trusts and how they might fit into your estate plan. To learn more, contact Cleveland, Ohio estate […]

How Does a Minimum Required Distribution Affect My Retirement?

Cleveland, Ohio Estate Planning Attorney If your retirement portfolio contains a Simple Employee Pension (“SEP”), or Simple IRA, you need to know how the minimum distribution system works. Cleveland, Ohio estate planning attorney Dan Baron provides the following remarks. One major attraction to IRA’s and other estate planning tools is the ability to accumulate funds […]

Creating a Business Succession Plan – Cross Purchase Agreements

Creating a Business Succession Plan – Cross Purchase Agreements Whether you’re planning for retirement or tragedy, having a business succession plan is imperative for business owners. Big business or small, planning for the financial stability of your partners and employees can mean the difference between business as usual and leaving your spouse bankrupt. Moreover, understanding […]

What is a Charitable Remainder Trust?

Unique Estate Planning Methods to Secure a Lifetime of Income, Save Taxes, & Benefit the Community Most people planning for their retirement have a misconception that charitable giving is only for the wealthy. However, there are several estate planning tools that can benefit your favorite charity while also earning you steady stream of income. One […]

Building a Charitable Contribution in your Estate Plan

Estate Planning Charitable Donations Have you ever considered incorporating a charitable donation into your estate plan? Aside from the tax benefits, including charitable giving into your estate plan is a wonderful way to extend your legacy and show your generosity. And contrary to public belief, charitable giving in your estate plan is not just for […]

Can a Beneficiary Force a Trustee to Provide Information Contained in a Trust?

Cleveland, Ohio Estate Planning Attorney Can a Beneficiary Force a Trustee to Provide Information Contained in a Trust? In addition to the blog below, do you have questions regarding estate planning or trust administration? Call Cleveland, Ohio law firm Baron Law LLC. An attorney at Baron Law will be able to assist you and provide […]

What is the Difference Between a Trust and a Will?

This blog will help you understand some of the core differences between a will and trust, but it is not intended to provide legal advice. If you’re planning for your estate, contact Dan Baron at Baron Law LLC. Call and speak directly with an attorney at 216-573-3723. Most people have heard the terms “will” and […]

Click here to add your own text